The Narrative

CoinTelegraph was able to talk with 796, and in combination with a post on weibo (hope you can read Chinese) the following narrative emerged. Being a bitcoin exchange they are always a target for theft and abuse, and three months ago they migrated their servers to a cloud host. However somehow a hacker was able to replace one users address with another similar address. At this point the hacker needed to simply wait for a transaction to be posted. And they got lucky with a large 1000BTC transaction.

This is the point of the story where one of the ugly truths of cyber defense becomes manifest. You have to be 100% in all of your defenses and secondary systems, but the hacker only has to get lucky once or twice. This hacker had already had some luck getting the data updated on the server. They had another stroke of luck getting the bitcoins out. First, the weibo post indicated there was another level of approvals needed to permit the transaction because the transaction looked suspicious because of the use of different IPs. But the transaction met the standards of approval so the transaction was processed.

About five hours later the customer who initiated the withdraw is in contact with 796 over the phone and they indicate the bitcoin had not shown up in the customer's destination address. At this point a full scale investigation is launched, and it is revealed that the coins went to an address that was similar to the address that was intended. This is where the hacker got lucky: by using a similar address it passed both 796 manual review and the customers manual review of the information. Because when it comes down to it 35 characters of randomness does get tiring on the eyes after a while and if you have to commit it to memory, you probably only memorize five characters or so.

After the details are sorted out and the investigation is concluded 796 owed up to the theft, and took the losses out of company profits. For 796.com client losses have a senior claim to shareholder losses, so there was no vote or consultation with the investors.

The Blockchain Evidence

On the 8btc.com forum (8btc is a Chinese language bitcoin forum) one post identified the theft address as 1CvGkU...2wrU. There was one large transaction at 15:50 GMT on 27 Jul. The whole of China is on the +8:00 time zone, so the timing of the transaction would be 23:50, consistent with the weibo post. It was then committed to block 340748 a nearly a minute later. So did a suspect transaction go out? The evidence does match the narrative.

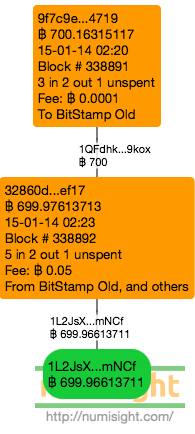

But there is also the second half of the narrative. 796 also said that they would take responsibility for the theft. About 13 hours later another withdraw of 999BTC is sent to the address 1CvGkM...vJwU. Not that the first four characters of this address matches the first five characters of the theft address. It also matches up with the claim of the insertion of a similar address. Note however, that this is 1 BTC short of making the customer whole. If we look at the other transactions to the 1CvGkM address we see another transaction an hour earlier.

Ignore the dates on the transactions. These are self-reported by the miners and the protocol allows for something on the order of two hours of skew. In the block prior to the 999BTC transaction a 1 BTC transaction is sent to the correct address. I presume that this was done to test the waters of their system to make sure that the reported address can be trusted. The next block is when the 999BTC is sent, and three blocks after that the customer then gathers the coins and spends it in two separate transactions.

These two transactions made the customer whole and the timeframe seems reasonable enough, being the next business day during business hours in China.

These two transactions made the customer whole and the timeframe seems reasonable enough, being the next business day during business hours in China.

Technial Details

You have probably noticed that I elide the transaction identifiers and addresses in my images and in my text. There is one principal reason for that, and it's not to protect privacy or redact data. The reason is that 64 hex digits in a row and 35 alphanumerics in a row are hard on the eyes. I take the six leading characters and the four trailing characters because one sixth to one third of the data is enough to reproduce my findings. There are many occasions where a single address or a single transaction when elided will look like another address or transaction id. However, when you assemble the network and take the elided addresses and transaction ids in context, the elided data provides enough information to reproduce the data displayed in my images.

The cognitive fatigue of looking at all of that data played a part in this hack, so it is my hope that by slashing the amount of data shown that the user might be able to process all of what is shown, rather than a part of the whole that varies between users. I am fairly certain that it is good enough for analysis.

In fact, if anyone can show me a transaction on the blockchain where one address combined with the input and output transactions cannot be distinguished from a similar transaction based on the elided values, I'll send you a box of girl scout cookies. Of course I'll only pay up when girl scout cookies are on sale. If you can show me one below block 340950 then I'll even let you pick the (in-stock) flavor of cookies. This offer is good only for the first taker however, and only in jurisdictions where they are legal (they are addictive after all).

The cognitive fatigue of looking at all of that data played a part in this hack, so it is my hope that by slashing the amount of data shown that the user might be able to process all of what is shown, rather than a part of the whole that varies between users. I am fairly certain that it is good enough for analysis.

In fact, if anyone can show me a transaction on the blockchain where one address combined with the input and output transactions cannot be distinguished from a similar transaction based on the elided values, I'll send you a box of girl scout cookies. Of course I'll only pay up when girl scout cookies are on sale. If you can show me one below block 340950 then I'll even let you pick the (in-stock) flavor of cookies. This offer is good only for the first taker however, and only in jurisdictions where they are legal (they are addictive after all).